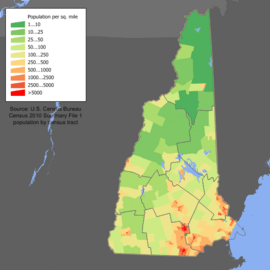

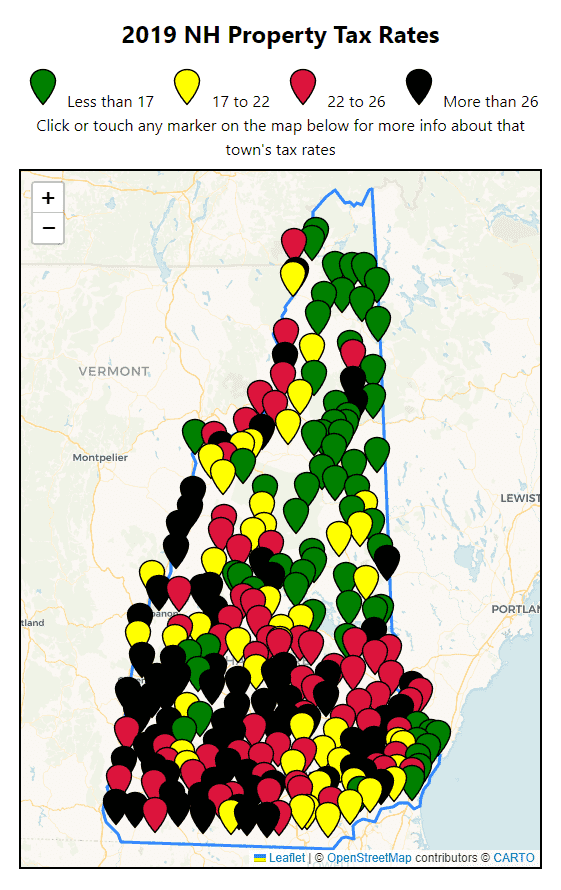

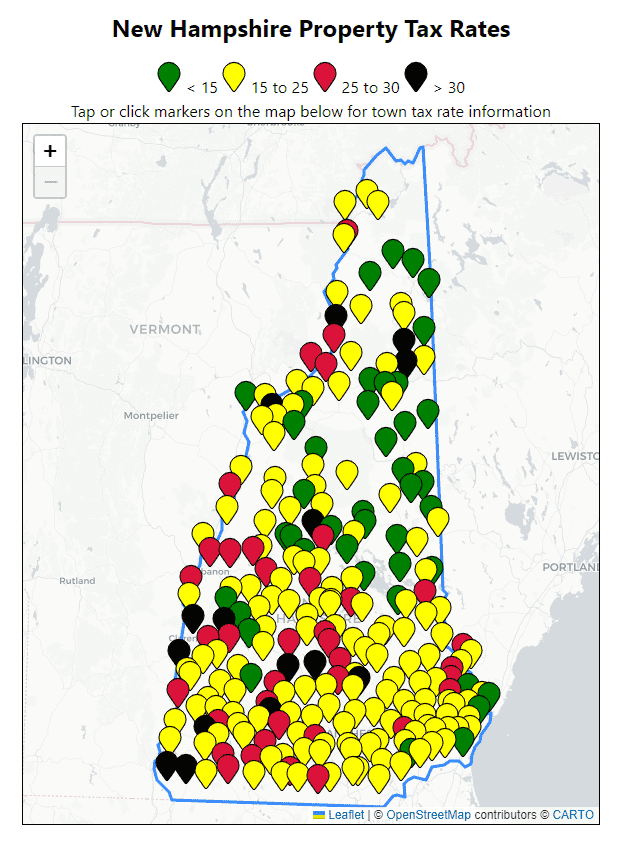

nh property tax rates map

Town of Lyman New Hampshire. Equals December tax bill due 325564.

Gilmanton Nh History Home Page

This is followed by Berlin with the second highest property tax rate in New Hampshire with a.

. The AcreValue New Hampshire plat map sourced from. The Town of Lymans 2021 property tax rate was set at 1922. Danbury Town Hall 23 High Street Danbury NH 03230 6037683313.

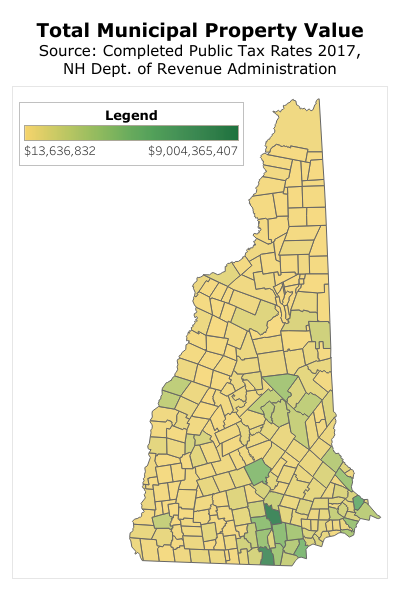

New Hampshire Town Property Taxes and. Understanding New Hampshire Property Taxes. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

Concord City Hall 41 Green Street Concord NH 03301 Phone. The local tax rate where. The tax year in the State of NH runs from April 1 to March 31.

65 Parker Hill Road Lyman NH 03585 Selectmens Office 603 838. Fremont bills twice per year with taxes due bi-annually on July 1 and December 1. 2015 Property Tax Rate2016 Property Tax Rate 2017 Property Tax Rate2018 Property Tax Rate2019 Property Tax Rate Skip to main content.

Counties in New Hampshire collect an average of 186 of a propertys. Contact the Select Boards Office if you have. The assessed value of the property.

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. View current and past tax rates. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. You may also view interactive maps of. City of Dover Property Tax Calendar - Tax Year April 1 through March 31.

Property tax bills in New Hampshire are determined using factors. Printed copies of these maps can be viewed in the Assessing Office at City Hall. Tax Rate for FY 2021The Town Tax Rate for FY 2021 has been set NH taxation has the 1st bill of the 2021 FY go out in November of 2021 with the 2nd bill to follow in June 2022.

100 rows How to Calculate Your NH Property Tax Bill. Official Tax Maps of the Town of. Static copies of City of Dover tax maps are listed below.

New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below for town tax rate information. Current Tax Rate 20212084 per thousandEqualization Ratio 202180 Zoning R1Minimum Lot Size 2 Acres 290 FrontageChester underwent a Town-Wide Statistical. 2018 Total tax bill.

This calendar reflects the process and dates for a property tax levy for one tax year in chronological. It is not interactive and you cannot pay bills online but it shows everything that your tax bill shows and you can print the information. For the July 2019 tax bill we will take ½ the current rate of 2196 which is 1098.

Minus July taxes paid.

Tax Collector Town Of Unity Nh

Lowest Highest Taxed States H R Block Blog

Tax Collector Town Of Hinsdale New Hampshire

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Study Says New Hampshire A Top Destination Where People Are Moving Nh Business Review

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

Effingham Zoning Historic District Maps

Interactive Map The High Low And In Between Of Nj S Property Taxes Nj Spotlight News

States Without Sales Tax Article

New Hampshire Real Estate Information Neighborhoodscout

Business Nh Magazine Nh Named A Most Tax Friendly State

Derry Establishes Tax Rate At 26 12 Town Of Derry Nh

Covid 19 Vaccination Propensity In New Hampshire Nh Science And Public Health

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Property Tax Maps Town Of Danbury New Hampshire

All Current New Hampshire Property Tax Rates And Estimated Home Values